This essay by Jamal Thomas won first place in the 2024 Henry George in the 21st Century Writing Contest for the College/University & Graduate Students level. Thomas’ work was previously featured on the Henry George School of Social Science website.

Being a Georgist in the 21st century is a painful experience. Much of the movement has either stalled or calcified with no real change coming soon. The movement needs innovative solutions, some ideas that can show, unequivocally, that our economic prescriptions work and should be attempted.

It is my belief that rolling Georgism into a private bank does this. Setting up a bank that is full reserve instead of fractional reserve, equity shares instead of issuing debt-based loans, provides customers with a basic income out of profits instead of interest rates catered to wealthy clients, and places land value taxes on properties fulfills the Georgist manifesto while leaving past restrictions in the dust.

Historical and current evidence points to similar effective banking, finance, and community products. So, it is time to privatize Georgism’s methods and publicize the profits to show it is viable in today’s world.

Georgism is constantly losing wars with rent-seekers and no current solution avoids this. However, given the transformative nature land value taxation and citizen dividends calls for, it is not surprising.

The late University of California Riverside economics researcher Dr. Mason Gaffney describes in detail how entire economic departments conspired to prevent anything other than Neoclassical economic dominance in his book, “The Corruption of Economics.”

“Few people realize to what degree the founders of neo-classical economics changed the discipline for the express purpose of deflecting (Henry) George and frustrating future students seeking to follow his arguments (Gaffney and Harrison 42).”

Dr. Gaffney carefully examined subtle ways definitions, meanings, and advancement were distorted against Henry George over decades. And this only shows how reform in the late 1800s to early 1900s was stopped. America has had other chances of successfully adopting Geoist reforms though none completely passed. Some of America’s Founding Fathers, in particular Benjamin Franklin and Thomas Paine, wrote and campaigned for land value taxation, only for their efforts to be rebuffed by compatriots.

“I have not lost any of the principles of public economy you once knew me possessed of, it is necessary first to remove the prejudices of the people, enlighten their ignorance, and to convince them that their interest will be promoted by the proposed changes, and this is not the work of a day….Our legislators are all landholders; and they are not yet persuaded that all taxes are finally paid by the land therefore we have been forced into the mode of indirect taxes, i. e., duties on importation of goods (Franklin).”

The US Constitution’s direct and indirect taxation clauses show the compromise eventually agreed upon (“Hylton V. United States, 3 U.S. 171 (1796)”). If we were to venture even further back, one can see their inspiration being none other than the French Physiocrats, primarily spearheaded by Francois Quesnay through his masterful, “Tableau économique” (National Archives).

None of these movements have generated the desired results and perhaps the reason lies in the Fundamental Law of Political Economy, crafted by the economist and author we hold so dear to our cause: “But whatever be its ultimate cause, the fact is that labor, the attempt of the conscious will to realize its material desire, is always, when continued for a little while, in itself hard and irksome. And whether from this fact alone…is that men always seek to gratify their desires with the least exertion (George 1897)”.

The current system benefactors will spend more energy stopping change than the people promoting reform since their stakes are higher. Nowhere is this more apparent than terrible backwards looking policies being promoted and passed whose only goal seems to be to lock in wealth and income inequality permanently, i.e., California’s Proposition 13 and general property tax exemptions. A solution is needed that will not strike wealthy rent-seekers ire so fast and forcefully. Shifting to the private sector by banking does this and much more.

Full Reserve Equity Banking is the final puzzle missing in Georgism. Fractional Reserve Banking, particularly private money creation, creates the wrong incentives for banks. Extracting profit and servicing high profit industries are made primary instead of seeking small businesses and building community wealth. Thus, it is more enticing for banks to service high net worth entities, whether it be through equity lines of credit or large business loan amounts because of the higher interest payments collected (McLeay et al., 2014, p. 13).

Researchers Dr. Michael McLeay, Dr. Amar Radia, and Dr. Ryland Thomas discuss this and other banking operations in detail in, “Money Creation in the Modern Economy.” Creating a bank that does not create loans out of thin air through double entry bookkeeping but is focused on building a diverse equity portfolio and local growth would be fierce competition for the status quo while also supporting all people involved (McLeay et al., 2014, p. 16). Currently banks use complex interest balancing and reserve lending to maintain their shaky operation.

If banks do not keep interest rates above the Federal Fund Rate, invest too much into a singular person or business, cannot meet reserve requirements, and several other problems, they can fail with the only relief being the Federal Deposit Insurance Corporation (FDIC) and possibly a government bailout. This instability is minimized and eliminated with Full Reserve Banking. But let us examine this further. Below is Northrop Grumman Federal Credit Union’s March 2024 balance sheet.

| Balance Sheet Assets | Consolidated Statement of Income and Expenses | ||||

| QTY | Amount ($) | Income | Month | Year | |

| Loans | Interest on Loans | 4,483,939 | 13,188,749 | ||

| Current and < 2 months | 38,756 | 788,566,864 | Investment Income | 2,817,935 | 7,818,036 |

| 2 to Less Than 6 months | 173 | 2,307,842 | CUSO Operating Income | 40,476 | 242,406 |

| 6 to Less Than 12 months | 18 | 456,672 | Fee Income | 330,432 | 1,023,877 |

| Member Loans | 38,950 | 791,412,619 | Gain/ (Loss) on Investment | 0 | 0 |

| Held for Sale Loans | 10 | 2,987,361 | Pipeline Income | 33,250 | 68,651 |

| Total Member Loans | 38,960 | 865,790,708 | MSR Income | 73,656 | 227,799 |

| CRE Participation Loans | 13 | 71,390,729 | Interest Income on Derivatives | 0 | 0 |

| Total Loans | 38,973 | 865,790,708 | Other Operating Income | 339,539 | 1,081,543 |

| Mark to Market HFS Loans | 58,267 | Total Income | 8,119,046 | 23,651,061 | |

| Mark to Market Portfolio Loans | 430,674 | Expenses | |||

| Net Loan Origination (Fee/Cost) | 97,053 | Salaries and Wages | 1,489,882 | 5,160,739 | |

| Discount – CRE Loans | (168,336) | Payroll Expenses | 484,958 | 1,555,335 | |

| Less Allowance for Loan Losses | (10,908,507) | Conference and Travel | 9,965 | 26,030 | |

| Net Loans | 855,299,859 | Association Duties | 7,767 | 25,190 | |

| Cash and Cash Equivalents | 303,024,481 | Office Occupancy | 136,234 | 408,948 | |

| Net Investments | 601,864,123 | Office Operations | 778,649 | 2,573,509 | |

| Accrued Income | 5,427,108 | Education and Promotions | 96,975 | 253,549 | |

| Prepaid and Deferred Expenses | 2,319,715 | Loan Servicing | 264,619 | 755,123 | |

| Total Fixed Asset | 7,568,835 | State and Federal Income Tax | 0 | 0 | |

| Total Other Asset | 25,124,251 | Outside Professional Services | 165,708 | 412,573 | |

| NCUA Share Insurance | 12,989,307 | Member Insurance | 0 | 0 | |

| Total Asset | 1,813,617,680 | Operating Fees | 25,714 | 77,142 | |

| Liabilities and Equity | Annual Meeting | 0 | 4,659 | ||

| Total Accounts Payable | 23,183,636 | Miscellaneous | (7,397) | (4,930) | |

| Notes Payable | 313,060,691 | Other Losses | 103,246 | 233,038 | |

| Shares and Deposit | Cash (Over)/Short | 4,526 | (8,538) | ||

| Share Draft | 237,956,063 | Total Operating Expense | 3,560,847 | 11,472,366 | |

| Term Accounts | 398,566,316 | Credit Loss Expense | 379,154 | 786,989 | |

| Money Market Deposit Account | 327,625,491 | Total Operating Expense | 3,940,001 | 12,259,355 | |

| Individual Retirement Account Shares | 72,541,530 | Net Gain from Operation | 4,179,046 | 11,391,706 | |

| Escrow | 2,766,487 | (Gain)/ Loss Non-Operating | (40,766) | (40,766) | |

| Total Member Shares | 1,393,681,369 | Net Gain Before Dividends | 4,219,812 | 11,432,472 | |

| Non-Member Shares | 0 | Dividends | |||

| Total Shares and Deposits | 1,393,681,369 | Term Accounts | 2,042,475 | 5,905,242 | |

| Capital | Regular Shares | 154,352 | 412,755 | ||

| Regular Reserves Undivided Earnings | 3,559,687 | Share Drafts | 18,898 | 53,472 | |

| Net Gain | 0 | California Deposits | 0 | 0 | |

| Total Captial | 143,179,400 | Total Dividends | 2,215,725 | 6,371,468 | |

| Unrealized Gain/(Loss) Investment | (59,487,416) | Capital Leases – Interest Expense | 3,247 | 6,360 | |

| Net Capital | 83,691,984 | ATM Leases – Interest Expense | 1,551 | 4,693 | |

| Total Liability and Equity | 1,813,617,680 | Interest on Executive 457(f) | 1,918 | 5,617 | |

| Interest on Borrowed Money | 1,231,832 | 3,604,184 | |||

| Total Cost of Funds | 3,454,273 | 9,992,184 | |||

| Income B4 NCUSIF Expense | 765,539 | 1,440,150 | |||

| NCUSIF Stabilization Expense | 0 | 0 | |||

| Net Income/ (Loss) | 765,539 | 1,440,150 | |||

Total assets are about $1.81 billion, with equity holdings around $160 million, and approximately $24 million in liquidity. This bank also has an exceptionally large loan portfolio that yields a large interest income. Finally, their Return on Equity (ROE), is approaching 1%. These are solid finances for an interest-bearing bank. However, current success does not guarantee future earnings for banks based in interest and fractional reserves.

Say the loan portfolio is not properly diversified and there is a slowdown. Then the bank would have defaults and interest income would also slip. Also, this bank has FDIC insurance limits that prevent customers from placing more than $250,000 without severe monetary loss risk, thus limiting how much liquidity can be gathered directly from customers (“FDIC: Deposit insurance at a glance,” 2022).

Finally, a country-wide recession would put the bank into failure territory vice some direct government assistance or FDIC rules bending like seen recently at Silicon Valley Bank and Signature Bank (Salmon, 2024).

Full Reserve Banking would not have these concerns since all the money lent out is backed by bank assets, interest is structured so it is taken out of profits instead of revenue so companies would not have the strain of debt pushing them into bankruptcy, and customers can deposit as much money as they desire into a their checking account without any fear of bank default. These bold claims need substance behind them, so here is an overview of how a Full Reserve Georgist bank could work.

Funding

Seeing that this proposed bank will use assets under management to fund operations, the assets in question need to be well diversified and have a high return on investment. Thankfully, most work in this area has already been figured out. The Financial Independance and Retire Early (FIRE) movement has personal financial guidelines that can be easily mapped unto a bank fund, which we will call the bank sovereign wealth fund (BSWF).

Ideally, the bank’s money needs to be invested into a broad portfolio of stocks and bonds to prevent market-specific slowdowns from bringing the bank down with it. This is accomplished through Exchange Traded Funds (ETF). ETFs are financial products that attempt to replicate the earnings of a certain stock index by holding a large variety of stocks and bonds usually weighted to market capitalization.

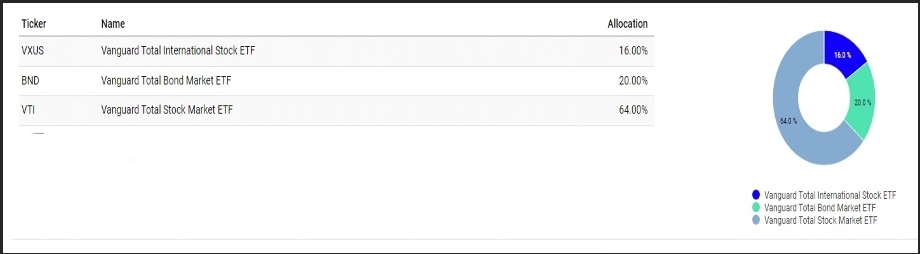

Taken to its logical conclusion, an ETF of the entire stock and bond markets would give the buyer exposure to the entire market capitalized stock and bond market, in this case the overall United States Stock Market being represented by the Vanguard Total Market ETF, the overall United States Bond Market represented by the Vanguard Total Bond Market ETF, and the market capitalized international stock market being represented by the Vanguard Total International Stock Market ETF.

A model of how the BSWF could be structured is shown by using the digital financial modeling tool Portfolio Analyzer below.

The ratios are created by following the FIRE principle found in the Bogleheads wiki specifically for funding a retirement using three ETFs (Bogleheads, 2024). This formation ensures a stable and robust return on investment (ROI), and we can see this by simulating the return on Portfolio Analyzer with data from 2015 to 2023.

This shows that this fund mix is expected to have around a 9 % annualized return.

Following Vanguard’s guidelines for dynamic portfolio withdrawal found in Fuel for the F.I.R.E.: Updating the 4% rule for early retirees translates to a yearly 3% withdrawal rate, with all other things being equal.

| Percentage | Reason |

| 8 | Conservative ROI estimate |

| -2 | Inflation |

| -1 | Negative Dollar Cost Averaging |

| -1 | Market Volatility |

| -1 | Margin of Error |

| 3 | Withdrawal Rate |

(Economics Explained, 2020)

Now, we split the 3 percent yearly withdrawal equally into three parts, 1% for a citizen’s dividend, 1% for savings, and 1% for administration costs. This should cover yearly operating costs and pay substantial profits to customers. Yet the bank also requires monthly revenue to be able to better adapt to market changes, so entry requirements could be used. Given that we are centering the bank around equity sharing instead of debt, three options are available.

The customer could contribute a percentage of labor income with the bank, the customer could provide business equity and therefore profit, and/or the landholding customer can provide land value. More will be discussed on these options later but now that yearly and monthly bank revenue has been defined, proper bank services can be further examined.

Checking Accounts

One major benefit of the proposed bank could be interest spread evenly among checking accounts. Given that currently interest received is tapered according to checking deposit amounts, more deposited means more interest added. This will not be the case in this proposed bank. Taking interest and spreading it evenly among customers would be more equitable and, at large enough amounts, simulates a Universal basic income or citizen’s dividend when funded through land value.

Also, given FDIC limits, in a conventional bank if the total amount in all accounts is over $250,000, the money would not be secured by the federal government (“FDIC: Deposit insurance at a glance,” 2022). Dr. Jaromir Benes and Dr. Michael Kumhof describe how full reserve banks would operate on the national level in the research paper “The Chicago Plan Revisited.” Translating central bank operation into private community banks gives clues as to full reserve bank characteristics.

We can see then that checking account limits would not be the case in a Full Reserve Banking scheme. Checking money is explicitly separated from investments, due to only secured loans being issued (Beneš & Kumhof, 2012, p. 03). Therefore, any non-zero amount can be in the checking with no loss risk.

Saving Accounts

Since we are changing how interest is being delivered to be more equitable, we will attempt the same for savings. The 1% set aside from the BSWF will be used to reward savers. When people place money into their savings account, the profits will be given out proportionally instead of interest tiered.

For example, $1 in a $100 BSWF fund would yield 1/100 future BSWF dividends. This way, bank members have an incentive to save since more invested equates to more profits apportioned out.

Business Loans

Another advantage over conventional banks is profit sharing over debt-based financing. Take a typical conventional $10,000 bank loan. After checking revenue, past debt, location, market forces, and credit worthiness, the bank would issue $10,000 to the business and expect regular payments thereafter with interest.

The expectation is for the business to pay the loan off as fast as possible, with the minimum payment option causing absorbent interest on top of the principle. If any changes happen that could lower revenue, the conventional bank will proceed to push for liquidating assets and bankruptcy. Not the same case for profit sharing agreements.

The proposed bank, using profit-sharing agreements, first creates a loan where the minimum and maximum interest is determined beforehand as a block amount, say $1000 in this example. Then, the business is given the same $10,000 but the payments only come from the profits and in equal amounts paid to the principal and interest.

So, when a downturn happens now, there is no payment required unless there is a profit. In this way, business success is aligned with bank profits. The interest paid does not increase or decrease with the amount too, so paying the loan fast or slowly does not change bank profits. To ensure businesses do not abuse this through long phases of unprofitability, the proposed bank could change the agreement into a conventional loan when it is determined that this is a better way to collect.

Yet, given the flexibility and ease this loan structure would give a business vice to the status quo, it is unlikely this would happen often.

Student Loans

Student loans are a fantastic way to differentiate the proposed bank from conventional options. Currently several options are catered to funding higher education. Yet proven, and better options are still not being tried, namely income contingent loans. Author Kevin Carey describes how other countries, like Australia and the United Kingdom, use this system and its benefits in the article, “The U.S. Should Adopt Income-Based Loans Now.”

Under income contingent student loans, Carey writes, students would pay a fixed income percentage from their paycheck back over the long term (Carey, 2011). This way, no student would ever default or have to suffer high loan payments right after college. If the student does not attain a job, there is no harm to the student’s credit score.

“If borrowers earn a lot, their payments rise accordingly, and their loans are retired quickly. If their income falls below a certain level—say, the poverty line—they pay nothing (Carey, 2011).”

This system ensures students can pursue careers without the financial stress conventional student loans now carry. These changes allow the bank to be involved in the student’s success, so barriers like transportation and housing would also be addressed through bank products, long term success is prioritized here.

Also, this loan arrangement would be ideal for occupations that require large upfront costs, namely cooperative businesses. Seeing that cooperatives struggle finding funding, the proposed bank could be a lifeline to this sector (Li et al., 2015, p. 05).

Personal Loans

The checking account dividend can be leveraged for personal loans. Given the checking dividend would be from BSWF yearly profits and given out in monthly installments, simply giving the dividend out earlier has the same effect as a personal loan without any loss risk to the bank. Take the previous business loan example of $10,000.

If the checking dividend is $1000, then a zero interest $10,000 loan can be issued with the condition being that for the next ten months the customer would not receive their monthly dividend.

This option would be a night-and-day difference from conventional bank personal loans, which regularly charge absorbent interest rates and punitive late fees. The customer is entitled to spend their dividend as they wish, and as fast or as slow as they wish, without interference.

Home Loans

Mortgages are where the proposed bank would be able to incorporate Georgism’s core tenet, land taxation. Currently 30-year fixed rate mortgages tracking the Federal Funds rate are the standard nationally. So, any alternative would have to aggressively compete with this option for potential homebuyers.

The proposed bank would accomplish this by issuing loans while paying property tax on the customer’s behalf. First, the bank would calculate the property land value and impose land taxes according to whatever tax rate the bank can set to equal what the customer would pay with a conventional loan. Then, the bank pays the property tax for the home and the customer pays the land tax in monthly installments.

In situations where the property tax is higher than the land tax, the bank pays the difference. If the reverse is true, then the customer pays the difference. Let us say the customer wants a $100,000 home loan. The proposed bank would calculate the land value through the cost or market land appraisal approach. After finding land value, the bank would impose a tax so that monthly payments are competitive with the 30-year fixed rate mortgage.

At the time of writing, a 30-year fixed rate mortgage, with 20% down and a 780 or better credit score, has a $600 monthly payment. So, the proposed bank makes the land tax high enough to equal $600 monthly payments. Every year the tax and the rate are recalculated and matched.

The main idea here is that the customer, receiving monthly dividends and favorable business loans, is motivated to only take out mortgages for useful property, since multiple mortgages would not be issued for property where the bank is expected to take a loss on, and because the customer would have to pay an unavoidable land tax otherwise.

Yet, the beauty of this plan is that this is done without a single government action required. Governments would have to break housing covenants and enter arbitration courts to interfere here.

Certificate of Deposit

Certificates of Deposit would work towards an amount, rather than a timeframe. Since money invested is the same whether it is kept in the account or liquidated constantly, encouraging goal amounts would be a better incentive than holding money and punishing for unexpected withdrawals.

If the customer needs to say, save for a trip, they can regularly allot checking monies to savings and allow dividends to be reinvested. When the goal amount is reached, the customer can be alerted and decide to withdraw.

Evidence shows full reserve banking has a high chance of success. Religions with restrictions on usury, financial exploitation through interest, have made equity centered banks with products like what is being discussed. Authors Zamir Iqbal and Abbas Mirakhor describe Islamic banking in the book, “Introduction to Islamic Finance.” Usury is called “Riba” in Islam. “Islam’s unconditional prohibition of Riba (discussed in detail in Chapter 3) changes the landscape of a financial system.

This prohibition implies the prohibition of pure debt security and ultimately of leverage through debt (Iqbal & Mirakhor, 2011, p. 09).” This restriction requires Muslims to resort to equity-based financial instruments for housing (Ijarah), business (Musharakah), and other functions. “Because interest is prohibited, pure debt security is eliminated from the system and therefore suppliers of funds become investors, rather than creditors.

The provider of financial capital and the entrepreneur share business risks in return for shares of the profits and losses (Iqbal & Mirakhor, 2011, p. 09).” In addition, private equity firms’ central funding is equity financing. In “A Comprehensive Guide to Venture Capital and Private Equity Investing,” private equity is described as entities “… usually used to finance more established companies that are looking to expand or restructure.

Private equity firms typically invest in companies that are not publicly traded on stock exchanges.” This mirrors equity-based banks more than conventional banks.

Also, the FIRE movement has crafted convincing evidence that its portfolio advice prevents severe monetary loss (Bogleheads, 2024). Finally, Full Reserve Banking would have several benefits over fractional reserve banking, as elaborated in modeling the depression era banking reform known as the Chicago Plan nationally (Beneš & Kumhof, 2012, p. 01). But perhaps the best property this solution has is that rent seekers cannot stop the process without exerting intense effort.

The status quo would have to craft new weapons from scratch to break up a community bank offering needed financial services. Their mission would be far tougher since scaling the proposed bank should be as simple as promoting small businesses and uplifting the population enough to gain local government approval.

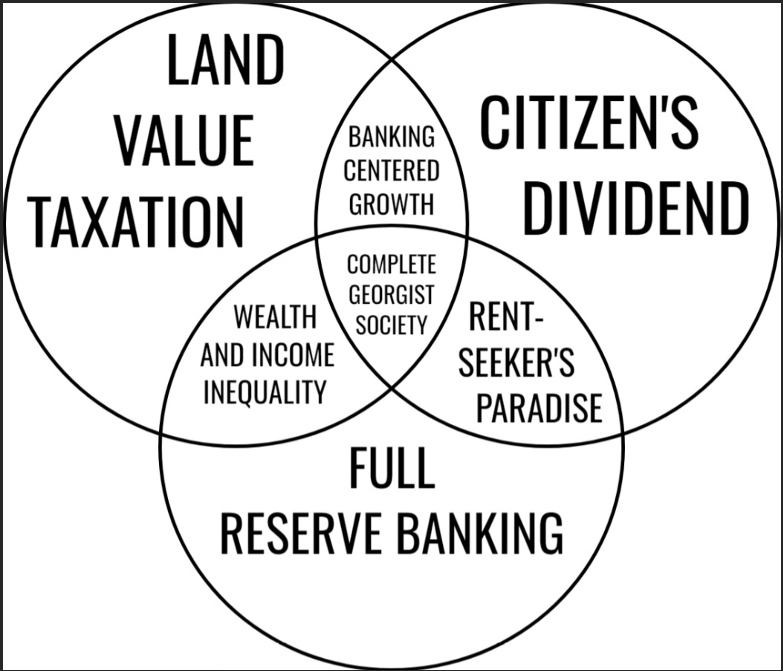

As more research concerning this solution is uncovered, it is becoming more apparent that not having all three Georgist tenets, land value tax, citizen’s dividend and full reserve banking, might ensure failure. Losing any core component creates adverse side effects the opposition can leverage as evidence that the whole prescription does not work.

Leaving out citizen’s dividend further increases wealth and income inequality by not returning land value back to the people. Leaving out land value taxation would flush all citizen’s dividend and other income into landlord’s hands and make rent-seekers even richer. Leaving out full reserve banking allows fractional reserve banks to collect returns and continue to push profits to wealthy bank depositors.

Private full reserve Georgist banking has its problems. Combining so many novel ideas is bound to create unique problems and since banks usually skew conservative, it is unlikely any similar reform would be attempted by any non-religious fractional reserve bank.

The Georgist movement is also very thin. Active members are few and far in between so splitting resources between building a bank and campaigning for government reform would slow progress on both. This brings up another crucial point, socialists are currently our allies and creating pro-market solutions could upset them.

Universal basic income and reining in banks are common goals Georgist and Socialists share, and this linkage has been leveraged in the past, for better or for worse as noted in, “Socialism vs the single tax” by author Darren Iversen on the Single Tax Gestalt Substack. So, alienating allies for an untested Frankenstein monster of products should be viewed with concern.

Full Reserve Georgist banking is worth fighting for. Innovative ideas need to be tried if the movement is to have any real change in material conditions. Banks and people do not like change, as Henry George has long ago informed us about, so catering to status quo conventional bank operations will not help.

The way to grow the movement, and eventually put more boots on ground campaigning, is testing, experimenting, and continually searching for optimal solutions. So, if this means that the ideological rift between Socialists and Georgists needs to be reopened again then so be it (Iversen, 2023). Even if this proposed bank ends in failure, showing the stark difference between both competing economic philosophies in the process needs to happen sooner rather than later. So hopefully the eventual break is loud enough for all to see.

21st century Georgists need some wins. The reform movement continues to falter and crawl along. Radical solutions are necessary for any real progress, The First Bank of Henry George does this. Placing all Georgism’s core tenets, land value taxation, citizen’s dividend, and full reserve banking, into one private product will finally provide a pathway forward unencumbered by government red tape and NIMBY rage.

Focusing on building equity locally will draw small businesses in and uplifting the local population through citizen’s dividend will surely make the opposition think twice about interfering. Time is long overdue that something breaks through, the world is burning for new answers. Let Georgism show the way forward and lead them by example. The First Bank of Henry George will welcome them all with open arms.

References

American Association of Individual Investors. (2017). Vanguard’s Dynamic Spending Strategy for Retirees. Investor Education: Stock research, tools, publication, investment clubs. https://www.aaii.com/files/PDF/9907_vanguards-dynamic-spending-strategy-for-retirees.pdf

Bogleheads. (2024, April 23). Three-fund portfolio. Bogleheads Investing Advice and Info. Retrieved July 5, 2024, from https://www.bogleheads.org/wiki/Three-fund_portfolio

Carey, K. (2011, October 23). The U.S. Should Adopt Income-Based Loans Now. The Chronicle of Higher Education. https://www.chronicle.com/article/the-u-s-should-adopt-income-based-loans-now/

Costa, P., Pakula, D., & Clarke, A. (2021). Fuel for the F.I.R.E.: Updating the 4% rule for early retirees. Investment Insights and Company Information | Vanguard. https://corporate.vanguard.com/content/dam/corp/research/pdf/Fuel-for-the-F.I.R.E.-Updating-the-4-rule-for-early-retirees-US-ISGFIRE_062021_Online.pdf

Economics Explained. (2020, September 20). What is the FIRE movement? Could it be hurting our economy? [Video]. Retrieved from https://youtu.be/AqSExy3HBm0?si=kKqkjhc1tKSU1bKb

FasterCapital. (2023, August 27). A comprehensive guide to venture capital and private equity investing. Medium. https://medium.com/@fastercapital/a-comprehensive-guide-to-venture-capital-and-private-equity-investing-8985cca4c96e

FDIC: Deposit insurance at a glance. (2022, September 13). FDIC: Federal Deposit Insurance Corporation. https://www.fdic.gov/resources/deposit-insurance/brochures/deposits-at-a-glance/

Franklin, Benjamin. “Benjamin Franklin / On Physiocracy — 1768.” The School of Cooperative Individualism / Welcome Page, cooperative-individualism.org/franklin-benjamin_on-physiocracy-1768.htm. Accessed 27 June 2024.

George, H. (1897). The science of political economy. Doubleday & McClure ; London.

“Hylton V. United States, 3 U.S. 171 (1796).” Justia Law, supreme.justia.com/cases/federal/us/3/171/. Accessed 27 June 2024.

Iversen, D. (2023, May 6). Socialism vs the single tax. Single Tax Gestalt | Darren Iversen | Substack. https://singletaxgestalt.substack.com/p/socialism-vs-the-single-tax

Li, Z., Jacobs, K.L. and Artz, G.M. (2015), “The cooperative capital constraint revisited”, Agricultural Finance Review, Vol. 75 No. 2, pp. 253-266. https://doi.org/10.1108/AFR-11-2014-0034

McLeay, M., Radia, A., & Thomas, R. (2014). Money creation in the modern economy. Bank of England Quarterly Bulletin. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2416234#

National Archives. “Founders Online: From Benjamin Franklin to Pierre Samuel Du Pont De Nemours, 28 ….” Founders Online, founders.archives.gov/documents/Franklin/01-15-02-0099. Accessed 27 June 2024.

Salmon, F. (2024, January 17). Big banks to pay $9 billion tab to cover last year’s bailouts. AXIOS. https://www.axios.com/2024/01/17/bank-bailouts-cost-fdic

ʻUs̲mānī, M. T. (1998). An introduction to Islamic finance. Arham Shamsi.

Leave a comment