A few disclaimers:

- The arguments presented here only relate to taxation itself, not any public spending which some might argue offsets the theft argument.

- Though the title of this article would make some think the private recipients of economic rent are thieves who should be punished, this isn’t the way to look at it and is not what this article calls for. This is a systemic issue, and most of those who capture economic rent are simply working within our current flawed system. More on this later.

With that being said, let’s move on to the article.

A phrase that has gotten popular recently surrounding the ideas of political reform is, “taxation is theft”. Often used to refer to those taxes which fall directly on the results of people’s hard work, like the income tax, it’s become a mainstay among libertarians in opposition to our current tax system and in calls for tax reform.

Just ask Ron Paul for example, perhaps the most successful political libertarian in modern American history.

When it comes to this sentiment, most Georgists across the board would agree, though only as it relates to taxing production (barring negative externalities).

Be it through working as a laborer or investing as a capitalist, Georgists argue that the results of people’s hard work rightfully belong to their individual creators and should not be taken by the government (and though there are some differences in views on how labor and capital should distribute the rewards for production among themselves, the point is that both of them should keep said rewards for themselves in full).

At the same time, seeing as how labor and capital alike can be reproduced through more jobs or investment, engaging in those forms of production doesn’t fundamentally exclude anyone from doing the same, making them positive-sum and beneficial.

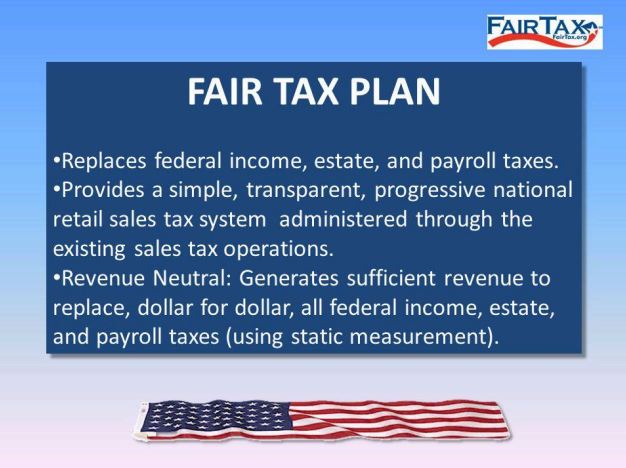

Unfortunately, many libertarians not aligned with the Georgists feel differently, instead advocating for other taxes on production like a sales tax. One of the most popular libertarian proposals for a tax reform was the FairTax, which would replace all forms of taxation in our current system with a national sales tax of about 23%, levied by the states.

Simply put, the FairTax proposal does not solve the problems of the current system, and switching to a sales tax would still stifle hard work and trade just as income taxes do now. This tax proposal is only accepted among libertarians because it’s more indirect and voluntary.

However, that doesn’t change the fact that sales taxation is still theft in the same vein, taking away the people’s right to trade goods and services freely, as it stands right now.

All of this is to say, taxing production and trade in their own right, regardless of how direct it is, is still a form of theft. From tariffs to income taxes, taking from the results of voluntary exchange and leaving those who engaged in them worse off is taking an honestly earned reward from the people.

This realization, while powerful, results in some very important questions: How should the state be funded if taxing production is theft? Is there no alternative for taxing the hard work of individuals and society as a whole?

Luckily for us, there is.

The answer to the question of optimally funding the government without taking from the people lies in taxing another form of income that takes from true labor: Privatized Economic Rent.

For readers who are unsure of what economic rent is, modern economics defines as the income of a resource with a fixed supply. Simply put, it’s the income of a resource which is non-reproducible.

The largest source of economic rent is, far and away, land. Seeing as how we quite literally can not exist without the ground we walk on, land is the most important resource we rely on which we can not produce more of.

There are others however, for example:

- The entire natural world, which is fixed in supply just like land is, from mineral deposits, to waterways, to even the Electro-Magnetic spectrum.

- Rights-of-way which give rise to natural monopolies like utilities.

- The ability to pollute, which allows free profits despite degrading the aforementioned natural world.

- Last but not least, legal privileges, which make resources artificial non-reproducible. An especially potent example of privilege are patents and copyrights over specific innovation.

These resources, by way of their scarcity owing to their non-reproducibility, can generate an income for their owners without requiring any production or use of them on behalf of their owners. This income is not based on what the owner of these resources has given, but rather how much society can afford to pay.

It’s from this where the problem descends. The private captors of economic rent effectively get an income, not through production and provision for society like laborers or capitalists, but by excluding everybody else from the resources we collectively rely on to do everything but can’t make more of.

Privatized economic rent, in essence, is itself theft from society based on getting an income from exclusion. If we want to see an example of rent-seeking in practice, the biggest showcase of it can be found in our current housing system.

Due to the profitability of the land beneath them, homes have effectively been turned into an investment tool to capture land rents from non-homeowners. Free profits in the land used for housing has contributed mightily to the Housing Crisis, where those who were too young or too poor to buy housing when it was cheaper relative to incomes have effectively been locked out of accessing valuable locations, by way of there not being enough housing in that location to satisfy demand.

Even rezoning, though a huge step in solving the crisis, can’t fully save housing from remaining scarce so long as the land rents resulting from zoning windfalls are up for grabs, in place of building homes.

Now, before I go any further, I want to elaborate on the second disclaimer I gave at the start of this article. The problem of privatized economic rent isn’t to blame on a specific group or class of people, the problem lies with our current system and the incentives it creates.

As we’ve already established, the United States, and almost all countries on Earth, tax production and leave economic rent mostly privatized. It naturally follows under this system that, for all people, holding non-reproducibles and not using them in order to seek out rents is a more valuable use of time than working or investing.

This is not a people problem, this is a system problem, one where the inevitable result is a society that keeps down true work and production while rewarding seeking out and capturing economic rents without doing anything in return, where making is kept down in favor of taking.

Simply put, our system works double duty in theft that throws off incentives: taxes on production and work, and the free privatization of economic rents. It’s a system of robbery in two ways that takes from true production twice. If we want to create a system where this two-headed robber is eliminated, then we need to flip the system on its head. How do we do it? By taxing economic rent instead of production.

Through creating a system where people are fully compensated for what they produce, and fully compensated for exclusion from what is non-reproducible, both forms of theft would be effectively neutralized.

The government would be able to fund itself by preventing economic rents from flowing unduly to the owners of non-reproducible resources, fixing the incentives around these resources’ use and preventing their hoarding and misuse; and at the same time, those who engage in positive-sum, beneficial production and trade would be allowed to fully profit their hard work and contributions without fearing the government coming by and taking a fraction of their righteous earnings.

With all of this in mind, the answer is simple. By taxing economic rent in lieu of taxes on people’s hard-earned and honest work, our current system would rid itself of these two forms of theft, giving us a far freer, rewarding, and honest system.

In the words of Henry George:

“Then, but not till then, will labor get its full reward, and capital its natural return.”

Leave a comment