Dear Indiana Lawmakers,

As you know, property tax has been a hot topic in the Statehouse during this session of the Indiana General Assembly. Indiana residents, like most people everywhere else, are seeking relief from high taxes from the public sector and high rent from the private sector.

Some folks call me the Homeless Economist. I am in this business because I believe we are all homeless until every person has full homeownership free from debt and taxes. I know for a fact that this can realistically be achieved in Indiana with a policy.

I am a member of the Plainfield-based Better Cities Committee, and I have a solution to make my cities of Indianapolis and Greenwood better. The solution is known as the land value tax reform, or “the Single Tax” as it was known when it first hit the scene.

This reform to the property tax is the solution we at the Public Revenue Education Council support to completely restore public finance and transform the state economy as a whole.

If we implemented the land tax reform, Indiana would experience a population boom and this policy could, in time, grow Indiana cities into thriving metropolises that could compete with other Midwestern giants like Cincinatti, Detroit and Chicago.

What is the Land Tax Reform?

The land tax reform was called the “Single Tax” because of its ability to replace nearly all other taxes to fund government. Indiana could easily eliminate income taxes and sales taxes while also receiving an increased tax base. This is no pie-in-the-sky promise, economists have been studying land taxes for centuries, and the effects are promising.

This tax system is so popular that it has its own internet following.

This concept of reforming property taxes is in no way new. Founding Father and author of Common Sense Thomas Paine, in his 1797 essay Agrarian Justice argued that:

“Every proprietor therefore of cultivated land owes to the community a ground-rent.”

This principle was supported by Thomas Jefferson, Adam Smith, and later popularized into a mass movement by economist Henry George. George’s 1879 work Progress and Poverty proposed a land value tax that shifts the tax burden away from improvements and onto land values.

This policy encourages development, reduces unaffordability, and provides a sustainable public revenue system.

Prominent economists, including the apostle of free market capitalism Milton Friedman, have praised the land value tax. Friedman, an advisor to President Ronald Reagan, called the property tax on the unimproved value of land or “the Henry George argument” in a 1978 speech “the least bad tax,” for its efficiency and fairness.

State lawmakers face a difficult challenge as property taxes fund critical government services. An old tax reform idea can save Indiana’s farmers and transform our cities.

Historically, Indiana’s efforts to reduce property taxes included state-funded property tax replacement credits, which were eliminated due to rising costs. Another proposal would use future state revenue to offset homestead property taxes, though this approach leaves funding gaps for essential services.

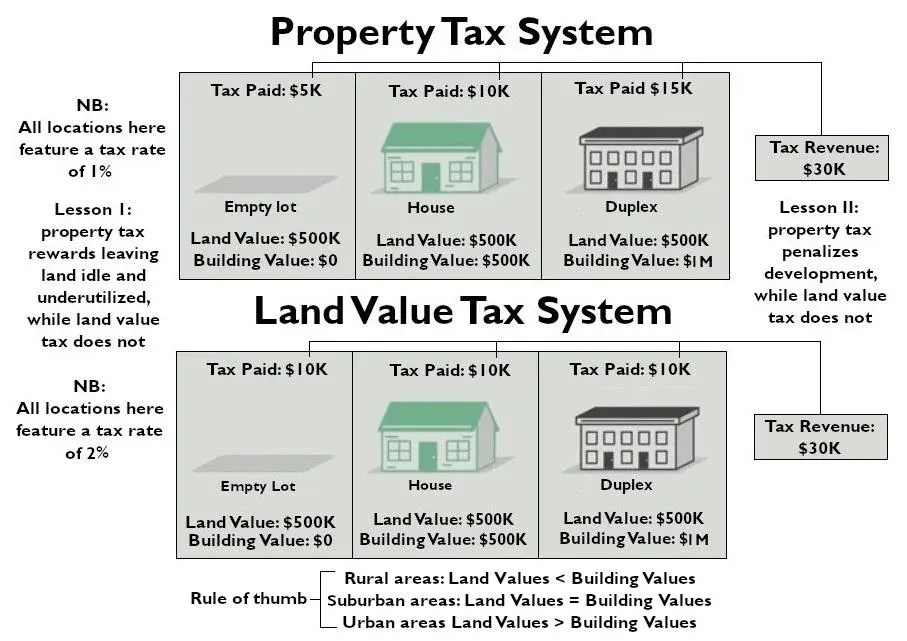

The current property tax system penalizes development and improvement while rewarding absentee ownership and land waste.

Property assessments are based on two components: the value of land and the value of improvements, such as buildings. Under the current regime, property owners face higher taxes when they improve their properties, whether it’s repainting a downtown condo or building a grain silo in rural Johnson County.

Meanwhile, land/location values, driven by community development and natural resources, are often undervalued in assessments.

This policy structure encourages practices like land banking, where owners hold land to profit from rising community-driven values, and contributes to urban sprawl, blight, and a disproportionate tax burden on working families, developers, and farmers.

Investors, Landlords, and Housing Affordability

The consequences of Indiana’s property tax system extend beyond unfair burdens. It exacerbates the state’s housing affordability crisis. According to a new report from the Fair Housing Center of Central Indiana (FHCCI), investors are increasingly dominating the single-family housing market.

“In Central Indiana, we see investors owning nearly half of all rental homes across five counties,” the report stated. Out-of-state landlords alone account for 23.4% of rental ownership, extracting an estimated $438 million annually from the local economy.

Investor ownership is particularly concentrated in low-to-moderate-priced neighborhoods, where some areas see up to 40% of properties held by mega-investors. The report noted that such neighborhoods face challenges like habitability issues, homelessness, serial evictions, and declining property values.

Renters in these areas also face higher housing costs, with the median rent for a single-family home in 2024 reaching $1,799 across the five counties. Mega-investors, often backed by private equity, prioritize short-term profits, eroding affordability and community stability.

As Indiana struggles to address housing shortages and affordability, experts point to land value tax reform as a potential solution. Municipalities that have shifted property taxes off improvements and onto land value have seen increases in housing supply and reductions in costs.

Farmers Feel the Pinch

Property taxes are especially burdensome for Indiana’s farmers, many of whom face complex assessment systems that do not reflect declining farm incomes. The Indiana Farm Bureau has called attention to the delayed formula data used in farmland assessments, which raises taxes even during economic downturns for agriculture.

At the same time, rural governments and schools struggle with funding. Tax revenue caps limit growth, even as costs for public services and infrastructure rise. Growing school districts and those with high losses due to tax caps frequently turn to debt to fund essential expenses.

Shifting to a land value tax would address these issues by basing taxation solely on the unimproved value of land rather than fluctuating assessments tied to farm productivity or building and machine improvements.

This would provide farmers with a more predictable and fair tax structure, and the relatively lower value of rural land means farmers are getting a tax break with a land tax reform.

A land tax reform would create a more stable and adequate revenue stream for rural governments and schools by capturing the true market value of land, preventing artificial shortfalls caused by assessment delays and tax caps.

A Path Forward for Indiana

Indiana policymakers have an opportunity to consider reforms that shift property taxes from buildings and improvements to land and location values. Such changes could incentivize development, increase the housing supply, and lower costs for homeowners and farmers who invest in real estate to use the land.

Cities like Pittsburgh and regions in Pennsylvania have successfully implemented land value taxes, spurring economic growth and reducing tax burdens. Even small Georgist-inspired communities, such as Arden, Delaware, and Fairhope, Alabama, have shown that this policy can work on a local scale.

For Indiana, an incremental approach might include establishing economic revitalization areas under state law (Indiana Code § 6-1.1-12.1-1). These areas could pilot a split-rate tax system, allowing policymakers to evaluate its impact before broader implementation.

A favorite policy choice of urbanists and reformers is the split-rate property tax which separates the burden on land and improvements, gradually shifting the tax burden off of improvement value and onto the land value.

If successful, this policy could relieve financial strain on rural communities, combat urban decay, and help counter the growing dominance of mega-investors in the housing market.

Indiana could become the first “Single Tax” State and drive economic growth through the efficient use of land and tax incentives. We would have a new and unique economic system that would become the talk of the Midwest, if not the entire country.

I am completely certain that a state-wide shift in property taxes off of improvements and onto land would dramatically revitalize Indiana’s part of the “Rust Belt” in areas around South Bend and Gary without displacing the current residents, as gentrification projects in the past have attempted to do.

Anyone interested in learning more about the land value tax theory and history can visit thedailyrenter.com Educational Resources page.

Leave a comment