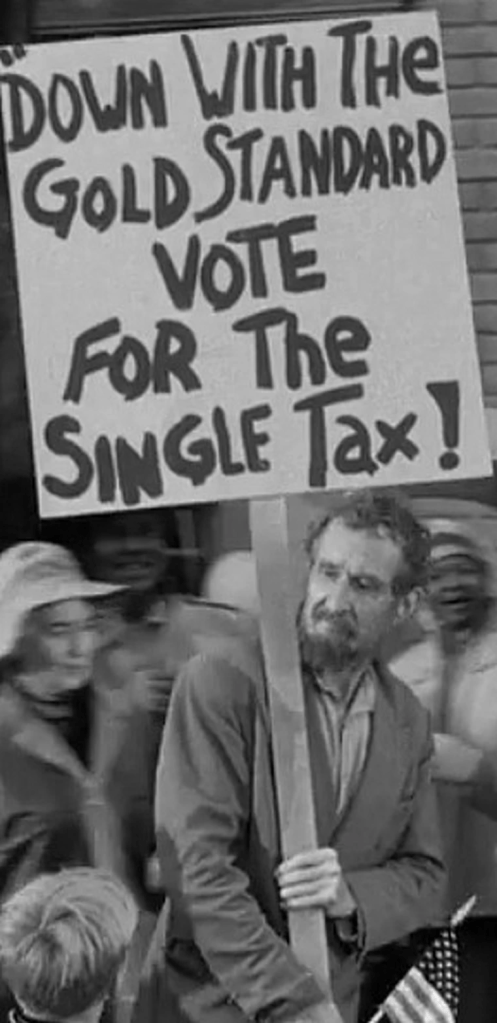

Long before the hip trendsetters, tech billionaires, crypto bros and influencers who pumped their shitcoins and NFTs for the past 10 or more years ascended to the White House, there was another populist fiscal reform movement in the turn of the previous century taking America by storm, known as the Single Taxers.

The Single Tax movement, spurred on by economist Henry George’s popular book on the causes of wealth inequality Progress and Poverty (1879), advocated for a tax solely on the unimproved value of land. The argument being that land should benefit the entire community rather than just private owners.

This approach was designed to eliminate other taxes on production and wages, aiming to reduce wealth inequality, eliminate speculation and hoarding of land, and fund public services.

The movement gained traction with experiments in land value taxation, particularly in cities like Philadelphia and Pittsburgh, and remains relevant today as rising urban rents revive interest in land value taxation as a solution to wealth disparity.

I’ve got to admit I had high hopes. The Department of Government Efficiency (D.O.G.E.) seemed like the perfect place to pitch my single tax proposal, the economic revive we so desperately need to fund public goods and services, eliminate taxes on workers and businesses, and finally put a stop to the rent-seeking behavior that drains our economy.

But much to my dismay, D.O.G.E. rejected me because I wasn’t “based” or “red-pilled” enough for their taste. Well, maybe I’m not red-pilled, but I am land-pilled! It might have also been that I went into the interview with grocery store bags tied on my feet instead of real shoes. Either way, D.O.G.E. missed out on hiring someone who could have really helped save some taxpayer money.

For context: I’m a proud board member of the PREC (Public Revenue Education Council), an organization dedicated to educating the public on how land value taxation (LVT) could replace every other form of taxation without reducing government revenue or increasing economic inefficiency.

But when I proposed that D.O.G.E. adopt the single tax policies of Henry George that is, to tax only the unearned income (a term in economics originally coined by Henry George) from land and natural resources while slashing taxes on labor, industry, and investment, I was turned down.

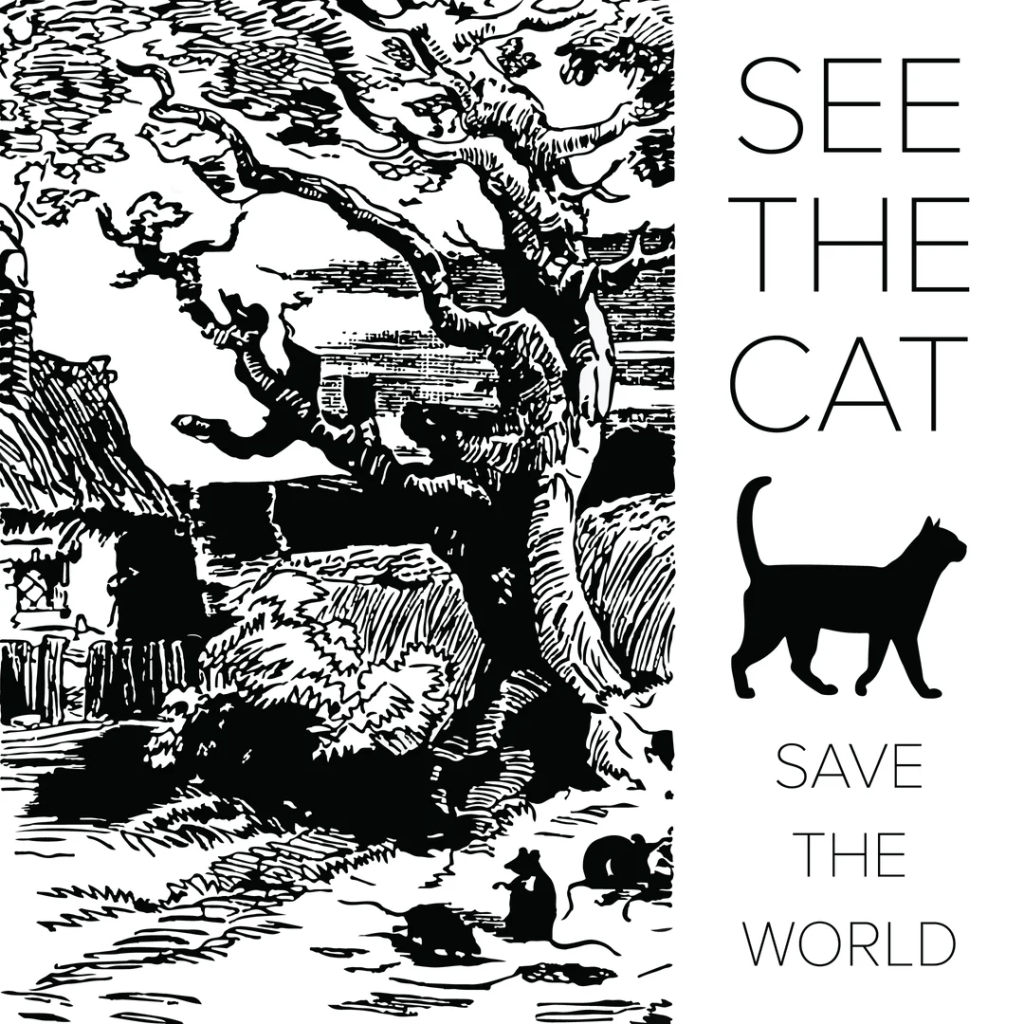

I guess D.O.G.E. doesn’t “see the cat” like I do.

“‘Seeing the Cat’ has long been a slang term for achieving an understanding of Henry George’s ideas. Where did this expression come from? Louis F. Post, in his book The Prophet of San Francisco, refers to a speech made by Judge James G. Maguire to New York’s Anti-Poverty Society in the 1880s:

‘I was one day walking along Kearney Street in San Francisco when I noticed a crowd in front of a show window… I took a glance myself, but I saw only a poor picture of an uninteresting landscape. As I was turning away my eye caught these words underneath the picture: ‘Do you see the cat?’ …I spoke to the crowd. ‘Gentlemen, I do not see a cat in the picture; is there a cat there?’ Someone in the crowd replied, ‘Naw, there ain’t no cat there. Here’s a crank who says he sees a cat in it, but none of the rest of us can.’

Then the crank spoke up.

‘I tell you,’ he said, ‘there is a cat there. The picture is all cat. What you fellows take for a landscape is nothing more than a cat’s outlines. And you needn’t call a man a crank either because he can see more with his eyes than you can with yours.’

This story, and this picture, have lasted for many years. For the cat – like the role of land in the economy – is utterly unmistakeable, once it comes clear. Do you see the cat?“

From a post on henrygeorge.org

Just ask Joseph Stiglitz. He’s a Nobel-winning economist who saw the cat and popularized the Henry George Theorem which shows that a full shift to a land value tax creates zero deadweight loss or distortions of productivity (talk about EFFICIENCY).

Economist Mason Gaffney showed us that land has a taxable capacity that can fund government and return the benefits directly to the people. It’s not just idealistic; it’s practical, it’s tested, and it’s mathematically proven.

But D.O.G.E. doesn’t want to hear about that. Instead, they’re caught up in the allure of populist catchphrases, focusing on “tax cuts” that only benefit the rich and “austerity measures” that harm anyone who isn’t in the rentier class (workers and small business owners). They’re missing the point entirely.

If I am ever one day lucky enough to be granted the same opportunity as Elon Musk to create a watchdog for government accountability and fiscal reform, I would create B.E.R.T., the Bureau of Economic Rent Taxation.

D.O.G.E. has a fundamental flaw: it arbitrarily defines “waste” in government based on the whims of social media commentators, the ever-changing mood of billionaires’ egos, or the latest round of political theater.

Elon Musk’s ego is a fragile thing to be staking the country’s fiscal policy on.

Efficiency in government should be built on clear, objective, and measurable principles, not a celebrity’s whims or Twitter beef. When we talk about waste, we should be talking about economic rent.

Economic rent includes untapped wealth that accrues to land and natural resources simply because of their scarcity, wealth that doesn’t come from human labor or productive capital, but from the withholding of land or natural resources from society. In other words, landowners and monopoly rent-seekers don’t create value, they extract it from others who have created it.

D.O.G.E. and its connection to the crypto bros involved with Dogecoin are part of a broader movement by financial rent seekers and speculators to re-package unearned income as “passive income”. The single taxers’ issue with the gold standard is that the rich were using gold as a speculative asset to pump and dump on the American taxpayers.

Look, I like a decentralized block-chain currency as much as the next guy, and I even used to be a gold bug, but a nation’s currency should be issued by the people’s own treasury and backed by the value of its land and natural economic productivity.

Taxing land rent can keep the government out of debt which means government-issued currency can remain both flexible and stable. But it also means it will not favor the lucky few owners of a particular financial asset like pegging the currency to gold bars, silver bullion or Bitcoin would do.

Economist Mason Gaffney’s ATCOR (All Taxes Come from Rent) principle explains why the land rent that’s untaxed today translates into higher taxes on labor, sales, capital, and industry. Every dollar of unearned income that goes untaxed means that the burden of taxation is shifted to working people and productive businesses. You want to talk about economic waste and inefficiency?

Economic rent is public sector money flowing into the feeding troughs of landowners, resource monopolists, and financial elites, all without them lifting a finger to contribute anything of value.

Think about it: high land prices are a massive driver of housing costs, which rip through the budgets of everyday Americans. The finance sector, dominated by rent-seekers, creates speculative bubbles and causes economic instability with usuriously high interest rates.

Rent-seeking is why monopolies like Big Pharma, insurance giants, and corporate landlords thrive, gouging consumers and restricting competition. Economic rent includes gains from political corruption, too, as it says here on Wikipedia:

“Rent-seeking activities have negative effects on the rest of society. They result in reduced economic efficiency through misallocation of resources, stifled competition, reduced wealth creation, lost government revenue, heightened income inequality, risk of growing corruption and cronyism, decreased public trust in institutions, and potential national decline”.

And all the while, the industrial economy, the sector that actually creates wealth and jobs, is burdened by taxes on wages and capital, and high rent charges by the FIRE sector. Trump’s tariffs and D.O.G.E.’s austerity measures won’t reduce this waste. They’ll only make it worse, ensuring the rich continue to accumulate wealth at the expense of the rest of us. The single tax system, however, reduces the cost of doing business by taxing what’s unearned: the land value, the economic rent.

B.E.R.T. is about cutting waste, but real waste. No more subsidizing the rent-seeking behavior of banking monopolies, price-gouging defense contractors, corporate landlords, or pharmaceutical and insurance giants. B.E.R.T. will aim to implement land value taxation on a massive scale, creating a public revenue surplus that can go straight into a Citizens Dividend, just like Thomas Paine’s Agrarian Justice or Henry George’s Progress and Poverty proposed.

B.E.R.T.’s agenda will be to “SEE CAT” or “Socialize (or maybe “Share”) Economic Efficiency and Cut All Taxes”. The idea of SEE CAT is to lead an economic reform initiative to eliminate all taxes on labor, sales, and production while funding public services through the return of economic rent (community-created value) to the public.

By capturing unearned economic rent from land and natural resources, SEE CAT ensures that economic growth is driven by productive work rather than speculative gains. This system promotes efficiency, reduces inequality, and empowers individuals by removing barriers to wealth creation.

This is the same principle that Norway uses in its sovereign wealth fund, where revenue from natural resources is shared with the people. Why should we let corporations and monopolists “drill baby drill” and hoard our country’s beautiful natural wealth? Let the public benefit from natural resource rents instead.

D.O.G.E. is fundamentally flawed because it doesn’t recognize the real waste that’s happening at the heart of our economy: economic rent. Until we understand that land and natural resources belong to everyone, we’ll never be able to build a fair and sustainable economy or government.

B.E.R.T., the Bureau of Economic Rent Taxation, is the way forward. It’s time to return the wealth of the land and natural resources back to the public, who created it to begin with. Only then will we see a true, efficient economy that doesn’t burden workers, industry, or the environment.

Leave a comment