As the United States housing market shows increasing signs of stress, Georgist economist Fred Harrison’s 18-year property cycle theory (which accurately predicted the 2008 crash in the 90s) is once again drawing attention.

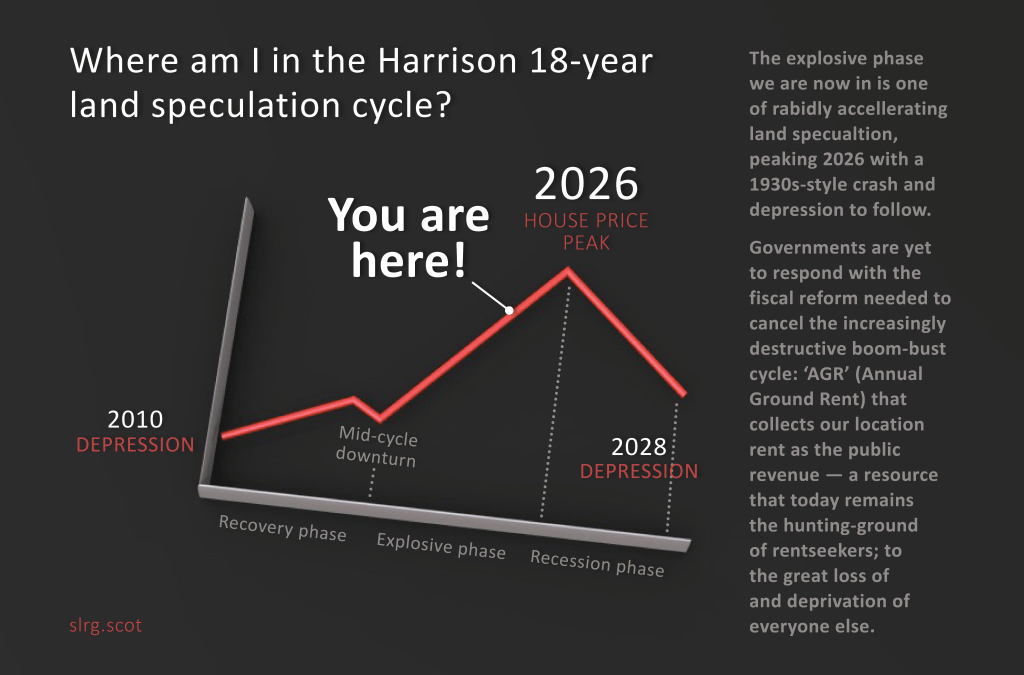

According to Harrison’s study of 300 years of land prices, the real estate market follows a predictable cycle of boom and bust with a peak occurring roughly every 18 years before a sharp downturn. His research suggests the next peak is set for 2026 followed by a severe correction, possibly a crash.

Recent actions by prominent investors including Warren Buffett indicate that the cycle may be playing out as predicted. Buffett’s Berkshire Hathaway is reportedly in talks to sell HomeServices of America one of the largest real estate brokerage firms in the United States to Compass.

According to The Economic Times Buffett rarely sells businesses unless there is a compelling reason which raises the question of why he is making this move now. The sale follows a reported 107-million-dollar loss in 2024 largely due to a 250-million-dollar settlement related to a real estate commission lawsuit.

Buffett’s hesitance to hold onto real estate assets aligns with broader concerns about the housing market. Soaring mortgage rates currently around 6 point 8 percent for a 30 year fixed loan have slowed home sales significantly.

In 2023, existing home sales hit their lowest level in nearly three decades according to the National Association of Realtors. Tightening credit conditions and declining affordability have led to increasing worries about a downturn.

“Buffett watchers” in business media are saying if one of the world’s top investors is stepping away from real estate it may be an early warning sign that the market is in for a rough ride.

Harrison has long argued that land values drive economic booms and busts. His theory rooted in Georgist economics posits that as land prices rise unchecked speculation drives the market into an unsustainable bubble.

When the heavily financialized housing and land market corrects as it did in 2008, instability follows. If Harrison’s model holds true, the current real estate turbulence may be a warning sign that a more significant collapse is imminent.

Commercial real estate is also under strain. Charlie Munger, Buffett’s late business partner, had warned of an impending crisis in the sector citing rising vacancies and shrinking investor confidence. Georgist economists like Harrison place economic land rent at the center of their models.

Economic land rent can be paid by workers to owners of residential properties, and businesses pay rent to the owners of commercial land and real estate. Both high residential and commercial rents can drive unemployment and housing insecurity.

Office vacancies have reached record highs and many commercial property owners are struggling to refinance debt amid high interest rates.

For homebuyers and sellers, the coming years may prove challenging. As borrowing costs remain high and demand slows, property values could stagnate or decline. Sellers are already facing price reductions and if the market follows Harrison’s forecast, a sharper downturn could occur by 2026.

Buffett’s potential exit from real estate may be the strongest signal yet that turbulence lies ahead. Whether this marks the beginning of a prolonged slump, or a full-scale crash remains to be seen but renters and homeowners alike would do well to heed the warning signs.

Leave a comment