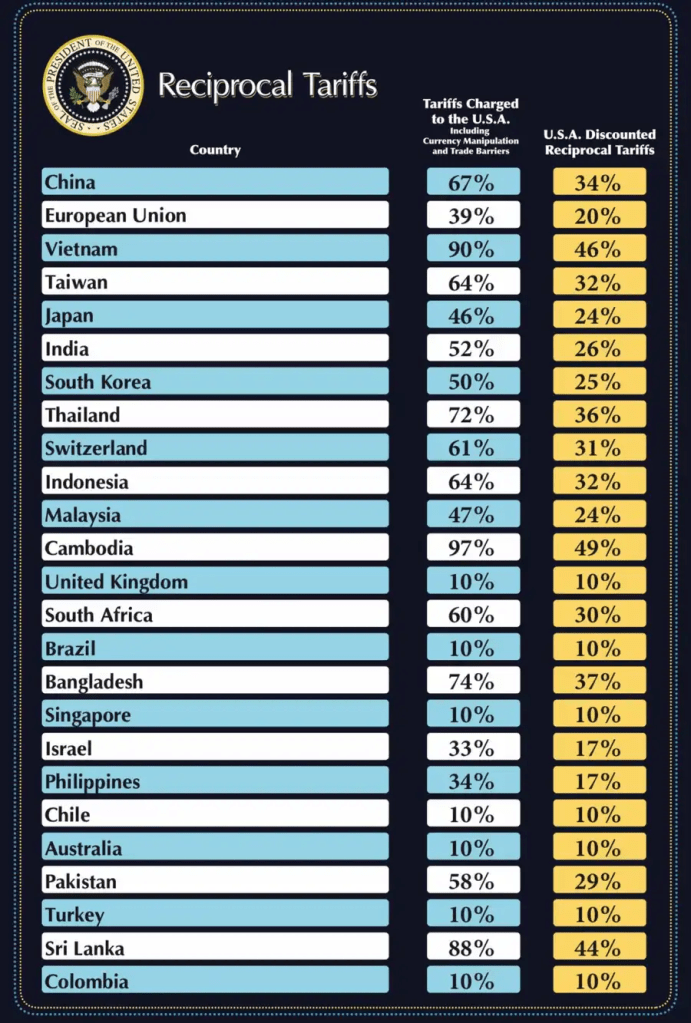

On April 2, President Trump announced a sweeping set of tariffs, setting a 10% general tariff on all imported goods to the U.S., excluding Canada and Mexico, along with targeted tariffs on additional nations. This move promises to reshape the landscape of U.S. trade policy, and reverses decades of free trade agreements and signaling a shift toward protectionism.

For renters and workers, the economic impact could be significant. The announcement was made after months of fluctuating tariff discussions and economic uncertainty. Some labor groups have praised the move, believing it will benefit U.S. manufacturers and workers who have long struggled under global competition.

According to President Trump: “Our country and its taxpayers have been ripped off for more than 50 years, but it’s not going to happen anymore” (via Tobias Burns and Sylvan Lane, The Hill).

However, the move has sparked intense debate and concern. Economists are warning that the tariffs, which affect everything from raw materials to finished goods, could increase the cost of living for everyday Americans, particularly renters.

The tariffs could cause inflation, impacting housing costs, utilities, and everyday goods.

The new tariffs are also expected to hurt industries heavily reliant on imports, particularly technology companies. As the tariffs target China and Taiwan with steep rates (up to 54 percent in some cases) tech companies like Apple and Nvidia could face rising production costs, leading to higher prices for consumers.

While businesses are already voicing concerns, trade groups have criticized the tariff increases, warning that retaliatory actions from other nations could damage global supply chains and hurt U.S. exports. The U.S. could face economic blowback from trading partners who are likely to impose their own tariffs in retaliation, further exacerbating inflation and pushing more people into poverty.

For renters, the situation is especially concerning. As tariffs on goods like steel and electronics rise, so too do construction and maintenance costs. Higher building material costs could lead to more expensive rents as landlords pass on the costs to tenants, further squeezing the already strained housing market.

For the same economic reasons, new homebuyers will also be paying more in mortgage interest rates.

“Tariffs could also impact mortgage rates, if they keep inflation higher for longer, as many economists fear they will,” wrote Kieth Griffith in an article for Realtor.com. “Prolonged inflation would prompt the Fed to reduce or reverse future cuts to its policy rate, which all else equal would keep mortgage rates higher for longer.”

It’s clear that President Trump’s new tariffs are designed to put “America First,” but renters and workers should prepare for the potential consequences: rising inflation, increased living costs, and economic uncertainty. The question now is whether these tariffs will truly lead to the “liberation” Trump promised or if they will create new hardships for those already struggling to make ends meet.

Leave a comment