The American dream of owning a home is drifting further out of reach as soaring prices, rising interest rates, and a nationwide shortage of affordable housing have sent shockwaves through the real estate market, and experts warn the situation is beginning to resemble the run-up to the 2008 financial crisis.

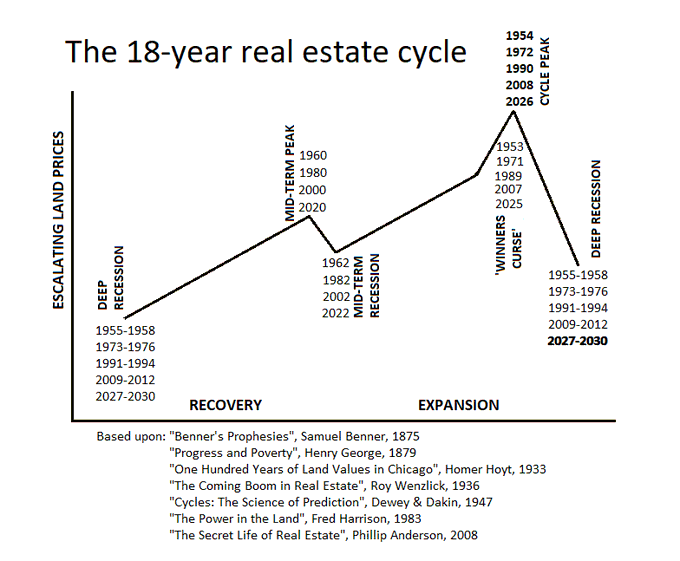

Georgist economists Fred Foldvary and Fred Harrison long predicted that 2025 would be in a “winners curse” in the real estate cycle, warning of a major housing bubble similar to 2008. Their forecasts, based on the 18-year land cycle observed by economists since the 19th century, align closely with current market conditions.

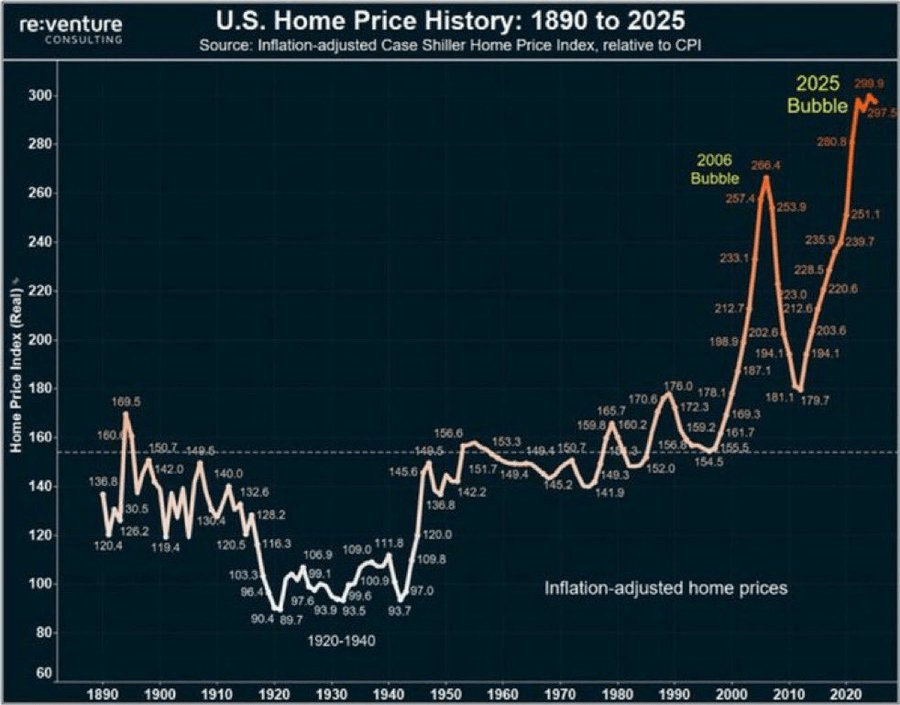

As shown in historical cycle charts and inflation-adjusted home price data, 2025 reflects the classic price bubble phase, a final surge in prices before a potential crash.

Mortgage rates have more than doubled since 2021, now sitting at an average of 6.82%, according to Realtor.com data from June. At the same time, home prices have surged 45% since 2020, pushing the average sales price to $355,328. In a climate where fewer Americans can afford to buy, home sales have plummeted to their lowest level in 30 years.

“The potential consequences of inaction are simply too harmful to the macroeconomy and the millions of households striving for a safe, affordable place to call home,” said Chris Herbert, Managing Director of the Harvard Joint Center for Housing Studies (JCHS), in a recent press release.

In its State of the Nation’s Housing 2025 report, JCHS paints a bleak picture. More than 20 million homeowners are now considered cost-burdened, spending over 30% of their income on housing. Renters face even steeper challenges (especially low-income families) with only 35 affordable rental units available for every 100 renters in need, according to The Daily Upside. That shortage has pushed 75% of low-income renters to spend more than half of their income on rent.

National homelessness has spiked to levels not seen since the Great Recession, with families increasingly forced to live in multi-generational homes or sleep in vehicles.

Homebuilders are throttling back. Housing starts are down 10% year-over-year, and builder confidence has dropped to levels last seen in 2012.

“Elevated interest rates” were cited by 91% of builders as a primary impediment to new construction, according to a January survey from the National Association of Home Builders (NAHB), referenced in the Harvard report.

Builders are responding to affordability pressures by constructing smaller homes and offering mortgage rate buydowns. Still, even as existing home sales tanked, new home sales crept up by 3% last year.

The uneven geography of the crisis adds complexity. States like Florida and Texas, which saw rapid pandemic-era development, now face oversupply in some regions and stagnating demand. Meanwhile, cities with tight housing markets remain strangled by high prices and zoning restrictions.

Harvard’s report urges action: zoning reforms, repurposing underused land, and investing in “missing middle” housing types such as accessory dwelling units and small multifamily buildings. These solutions echo the effects Georgist economists have shown land value tax creates for addressing the affordability crisis.

Yet multiple headwinds persist. Tariffs on construction materials are expected to add nearly $11,000 to the cost of a new home. Labor shortages continue to hobble the industry. Builders also cite inflation, high land costs, and buyers’ dwindling purchasing power as obstacles to ramping up supply.

The situation is so dire that some analysts are drawing parallels to 2008, when the housing market collapsed under the weight of bad loans and financial speculation. Today’s crisis, however, is driven not by excess, but by extreme scarcity, and by financial barriers that have boxed out an entire generation of would-be homeowners.

Leave a comment