The current economic dichotomy is flawed, and there is no greater show of it than the infighting between the two primary players of the production and trade that keep society flowing. In many calls for reformations to our current market system, upholding one means pushing down the other. Be it in the form of warring against unionization, or raising heavier taxes on the profits of businesses and their capital.

Each proposal fighting for one side or the other brings its own tradeoffs; inefficiencies and inequalities abound when the oxygen in economic discourse has been severely polluted by Labor and Capital warring with the other instead of the deeper, more insidious enemy that is yet to be dealt with.

The True Enemy

What is the true enemy that stings both workers and investors? Simply put, it’s those who benefit from Monopoly. That is ownership of a resource which is non-reproducible, whether by the laws of man or nature, and the unearned income that accompanies it, economic rent. There are several sources of economic rent that give rise to Monopoly. For example:

- Land

- Subsoil resource deposits (like oil wells and mines)

- Patents and copyrights over specific innovations

- Use of the electromagnetic spectrum (in particular radio frequencies)

- Water rights

- The rights-of-way used by natural monopolies like utilities or telecommunications

And many more.

Those who own these resources are able to profit off withholding or exclusively using what both laborers and capitalists need but can not produce more of, granting them power in the market by taking it from the two productive factors.

What results is a burden that gets dropped on work and investment, keeping the economy from working at its best and leaving only the powerful monopolists intact. Society, in turn, suffers.

The Many Faces of Monopoly

Take land as an example, everybody needs it but can not get it from anyone other than those who own the land. Knowing that the rest of society can not make more land for cheap, those who own land can charge the rest of society as much as can be afforded.

Land brings massive gains without doing anything itself. How large are these gains? They’re in the hundreds of trillions, forming a massive portion, if not a majority, of the value of the largest asset class in the world, real estate. In the United States’ largest cities for example, land forms about 50 to 90 percent of all real estate value.

What does this mean for Labor and Capital? It means they must dedicate a heavy portion of their costs to paying for access to land, be it renting out a parcel or taking out a loan with a down payment. The latter adds further insult to injury by requiring extra interest payments for the land that is siphoned off to the bank. Even worse, land prices are heavily skewed by acts of speculation and hoarding that grab a portion of the ground’s value without providing anything of use in return to those whose paths they tread on.

The average person who works finds it more difficult to afford a house by the year. Farmland investment is pushing out working farmers, both workers and capital-owners in their own right, in favor of land speculators. Small businesses, led by capital-owners that hire workers, are in crisis with increasing costs of contract rent, much of which is the economic rent of land. All these issues can be heavily attributed to land, and the hunting of the profits associated with its exclusive ownership.

How about another example? Patents and copyrights (which I’ll call P&Cs for brevity) are legal protections which grant non-reproducible rights to use an invention. Owners of P&Cs are able to extract economic rents in a few ways, two primary methods being:

- charging higher prices to consumers above what a competitive market would fetch

- licensing the patent/copyright to another user, like how a landowner would rent out their non-reproducible plot of land to a commercial or residential user.

P&Cs over specific innovations are almost equivalent to “land” in an economic sense, a valuable resource which is non-reproducible by any others. While the returns of P&Cs are designed to be rewards for providing a useful innovation to society, they do so in a way that’s incredibly risky. and, unfortunately, prone to backwards incentives.

Big Tech companies will find copious amounts of extracted income by using their enormous armada of P&Cs to deny small tech competitors. Be it bundling their intellectual privileges to fully monopolize whole services, licensing them out, or just using them as a weapon by suing anyone unfortunate enough to cross paths with its protections.

Just like with owning land, laborers and capitalists are quashed under this monopoly privilege. Capital-owners are unable to access, well, capital that would help make their operations more productive and their goods and services more desirable and profitable. They are forced to bow down to those mega-corporations and speculators that carry out the most extensive hoarding of the exclusive rights to use the innovations that would improve their operations.

As a result of this, laborers are hurt as well. The efficiency in the economy that creates jobs and mobility is lost when the knowledge that enhances our society is hoarded or speculated on. While there needs to be a reward for innovation, the way our current system does so, handing out non-reproducible rights to use those innovations without any payment for the privilege, is one that needs serious improvement.

The misuse of P&Cs and land-banking are a tell-tale sign that some of the worst problems Labor and Capital deal with today are not caused by their work in the economy. It is Renterism and the backwards dedication towards the hoarding and capturing of economic rents that take an ever-larger piece of the pie from each without growing it for either.

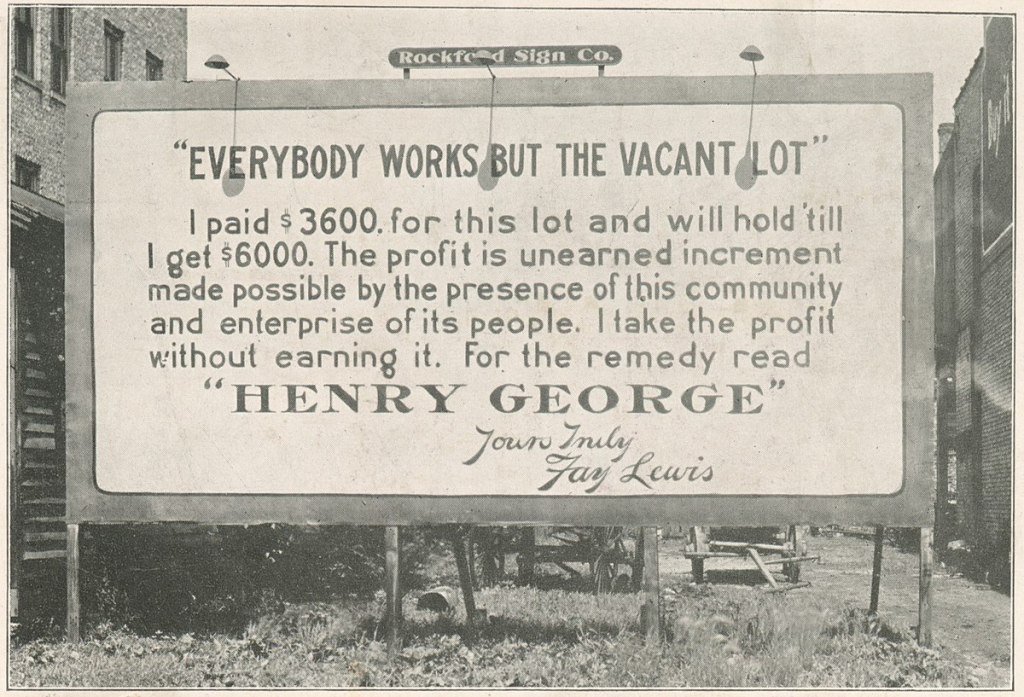

Those who claim the worker or the capital-owner are the source of the problem are blind to the greater enemy that lies deeper. Henry George detailed this in a testimony to the United States senate in 1883, as he put it then:

“I believe the conflict is really between labor and monopoly. Capital is the instrument and tool of labor, and under conditions of freedom there would be as much competition for the employment of capital as for the employment of labor

…

The large businesses which yield great returns have in them always, I think, some element of monopoly.”

This ownership of these privileges and powers that others can not have or compete for, is that greater enemy. Before we as a society can begin talking of the relationship between labor and capital, we have to acknowledge how heavily the well has been poisoned by, as George called it, monopoly.

The First Step

The first step to remediating the issues in our market economy and strengthening both the workers and capital-owners is simple. Let them, as producers, keep the value of production, and let the value of these non-reproducible privileges belong to society, or be dismantled.

Don’t tax the incomes of a laborer’s wage or a capital good’s yield, don’t tax the sales of goods and services that are created by labor and capital together, don’t tax the creation and upkeep of the buildings that house both in some capacity. Instead, tax the rent of land, tax or dismantle the rent of P&Cs in a way that keeps the innovator well rewarded, tax the value of the severance of water from its source, tax the use of the EM frequencies used for modern communications by broadcast licensees or IT platforms.

Switch from taxes on work and investment to the sharing or reducing of rent, end the regime of harmful taxes and rent-seeking which stifle true production. Only by fully realizing that dichotomy between production and trade versus the non-reproducible, will we be able to give ourselves a clear head on the true relationship between labor and capital.

Leave a comment