Mayoral candidates supporting LVT win in Seattle and Buffalo as LVT grows more mainstream.

Editor’s note: this article originally appeared on the Progress and Poverty Substack on November 17, 2025.

By Greg Miller

To achieve policy results, you need policy champions. This election cycle delivered them. Across the country, mayoral races elevated candidates who openly support land value tax, giving the movement credible voices in city halls from coast to coast. Since my last Landscape update, LVT has not only made electoral gains, it has also seen a surge in media coverage and public visibility across the political spectrum. Land value tax is going mainstream.

A Mayoral Win on the West Coast

Katie Wilson defeated Bruce Harrell by very narrow margins. The race took eight days past the election to be called, and she leads Harrell by only 2,000 votes as of this article. Wilson is a progressive candidate, a self-described democratic socialist, and despite not having been elected to public office before, she has been a community organizer for years, leading ballot measures for higher minimum wages and stronger tenant protections.

On her campaign website, Wilson endorsed shifts to land value taxes as a property tax reform to incentivize development. This result comes at an apt time. As I previously wrote, Spokane has made a land value tax a legislative priority for the upcoming session, and Wilson wants Seattle to join that effort. She states that under her leadership, “Seattle will join Spokane in advocating for a Land Value Tax.” If I am not mistaken, Wilson’s win will make her the sitting mayor of the largest city in the United States with an active interest in land value tax.

Just as notable, her platform supports the use of exemptions to provide tax relief for lower and middle income households. Spokane is shifting their legislative efforts towards a universal building exemption as a mechanism that shifts the property tax burden onto land value without facing constitutional limits on taxing land and improvements at different rates.

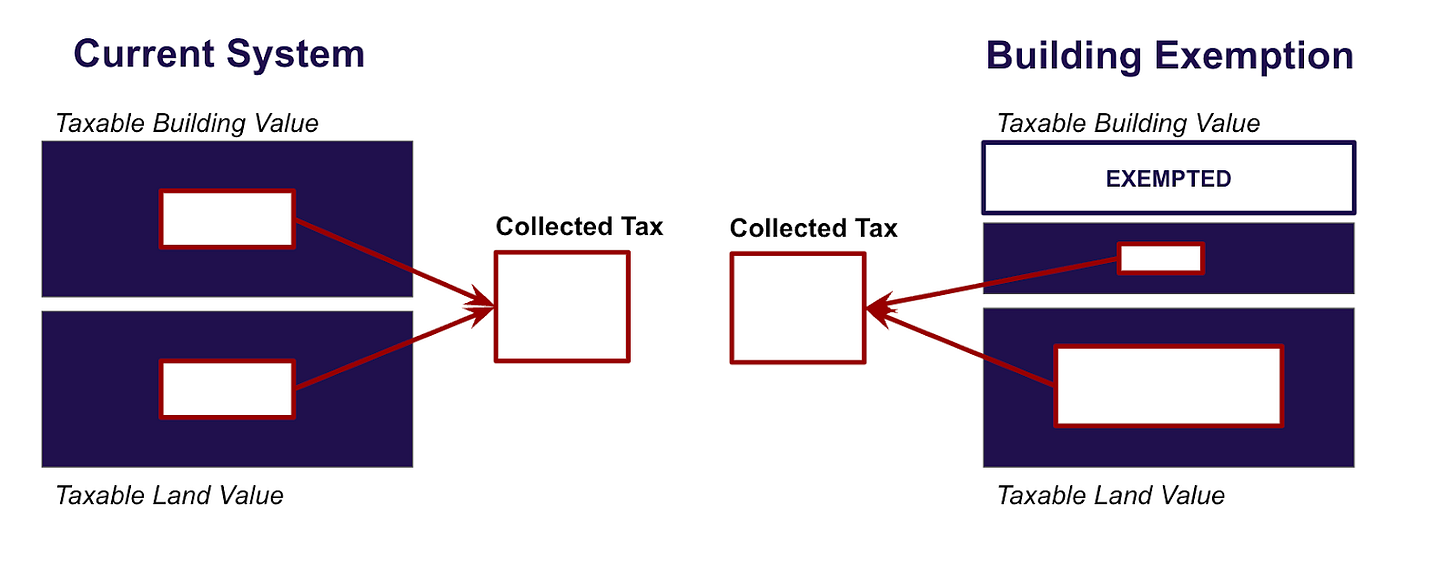

Here is how it works: Under a universal building exemption, the taxable value of buildings is reduced or removed for all properties. The land value remains fully taxable. In the current system, both land and buildings contribute to the total tax bill. With an exemption in place, the building portion is excluded, so the tax base naturally shifts onto land value while keeping total revenue constant. The result is that property owners who develop and improve their sites pay less, while owners of valuable but underused land pay more. The graphic below illustrates this transition from the current system to a building-exempt system.

Katie Wilson will likely be an ally in the state legislative push to make this policy a reality.

A Mayoral Win in the Midwest

Minnesota has been working to pass legislation that would enable Minneapolis and St Paul to implement land value tax shifts. In Minneapolis, all mayoral candidates both Republican and Democrat endorsed land value taxes in a response to a Neighbors for More Neighbors questionnaire.

Incumbent Mayor Jacob Frey won the election, but there is more to the story. Omar Fateh, a progressive state senator who has sponsored LVT-enabling legislation, challenged Frey and was quickly dubbed the “Mamdani of the Midwest.” He fell short in the mayoral race but will continue serving in the state senate through 2026. For the LVT movement, this creates a promising alignment: Minneapolis now has a sitting mayor who supports shifting taxes onto land value, paired with a committed legislative champion in the statehouse.

Frey’s support for LVT should not come as a surprise. He embraced YIMBY/abundance politics before it was cool. After being elected in 2017, he advanced the ambitious Minneapolis 2040 plan, and under his leadership the city became the first major jurisdiction to eliminate single-family exclusive zoning. Duplexes and triplexes became legal on every lot. At the time, the YIMBY movement was growing but still viewed as a mostly coastal phenomenon.

Even so, Minneapolis continues to face a shortage of housing and needs more development to bring costs down and strengthen the regional economy. Realigning property tax incentives is a necessary part of that work. With Fateh in the legislature and Frey in city hall, there is an opportunity for Minneapolis to finally move toward a land value tax system.

Don’t Forget Detroit

Detroit held its mayoral election to replace Mayor Mike Duggan, a champion of LVT who is currently running for Governor of Michigan. City Council President Mary Sheffield won the election, securing the Mayor’s seat.

Sheffield has been cautiously supportive of land value taxes. In an original response to a questionnaire from Outlier, she included land value tax as part of her campaign, but she later walked that back. This is likely part of the political game as she looked to build a broad coalition and avoid pushback.

Implementing LVT in Detroit requires state enablement, and the effort was only one vote short a couple of years ago. If outgoing Mayor Duggan succeeds in his gubernatorial run next year, the odds of enabling legislation rise significantly. Under that scenario, Sheffield may revisit her position on land value tax.

Duggan is running as an independent, which gives him long-shot odds, but he has been gaining momentum. He was recently featured in a Politico Playbook newsletter, and his chances climbed from roughly 15% odds of winning to 28% in the past few weeks based on Kalshi odds as he continues to grab the support of politically powerful coalitions. This race is worth watching.

A Mayoral Win on the Great Lakes

In Buffalo, New York, Sean Ryan secured the mayoral seat. Ryan has expressed interest in land value taxes and wants the city to explore the policy. New York State has been considering legislation that would allow five cities to adopt split-rate property taxes, giving them the ability to tax land at a higher rate than buildings.

I was recently in upstate New York, including a trip to Syracuse where I met with city and state officials and local organizations to discuss the potential for a land value tax. I also spoke on a panel hosted by the American Planning Association for Upstate New York, alongside Eric Cooper, a local planner, Josie Faass, Executive Director of the Progress and Poverty Institute, and Zach Zeliff, Chief of Staff for New York State Senator Rachel May. The interest in land value tax across upstate New York is unmistakable as these postindustrial cities look for tools to revive their economies.

Results Across the Country

The wins in this cycle tell only part of the story. Across the country, a wave of candidates brought land value tax into local debates, expanded public understanding, and built the groundwork for future victories. Here are a few stories from folks that ran promising campaigns:

In Marietta, Georgia, Sam Foster, a 24 year old candidate was less than one hundred votes away from outing an incumbent mayor. He endorsed LVT in a Reddit AMA and used social media videos to get residents to understand the importance of land value. Getting this close to a win is an impressive feat and should be an inspiration to the young politicos out there. Run for office.

David Dussinger is a Republican in Williamsport, Pennsylvania and ran with the hopes of introducing a land value tax. He finished a few percentage points away from a city council seat.

Dana Bullister finished sixth in Cambridge, Massachusetts putting her two spots out from a city council seat. She is a PhD student at Northeastern and is an outright supporter of land value tax.

Sam Purinton ran for town council in Gotham Maine and appeared on the LVT Landscape Live last month to discuss the need for LVT in Gotham.

Keith Leinhares ran for city council in Worcester Massachusetts as a champion of land value tax, even writing a local viewpoint article making the case.

John Lembke ran for city council in Longmont, Colorado having previously limited experience in city politics. His campaign focused on reforms such as ranked choice voting and land value taxes. Although he did not win, I know from speaking with him that he helped move these issues into the broader conversation among candidates. Sometimes winning is not the only impact a campaign can have.

If I missed any LVT wins, reach out and let me know.

More than Election Wins: Ohio Constitutional Amendment?

Beyond elections, land value taxes are also gaining traction in state legislatures. Ohio is the most recent state to join the conversation. State Senator Louis Blessing is a Republican representing suburbs of Cincinnati and has introduced a constitutional amendment to enable cities to tax land at a separate rate than buildings. In his words, “it’s simply an option.”

Blessing chairs the Senate Ways and Means Committee and has an understanding of the land pressures shaping the Cincinnati economy. From vacant lots to surface parking, he sees a pattern of underused land holding back development. In promoting his amendment, Blessing argues that “this amendment allows our state to do more with less by lowering taxes, shifting the system away from levies, and incentivizing productive use of land.”

In talking with Blessing it becomes clear he is well-versed on the issue. Of course, he knows how the policy will spur housing development, but he is also the type of LVT supporter that understands the fundamentals of what makes LVT important: it’s the least bad tax. (Set aside some Pigouvian taxes).

His effort will be welcome news to William S. Peirce, Professor Emeritus of economics at Case Western Reserve University and former Libertarian gubernatorial candidate. Peirce recently published an editorial for a Cleveland news outlet criticizing proposals to eliminate property taxes in Ohio and instead endorsing land value taxation. His piece is well argued, and his conclusion is especially sharp. Reflecting on attempts to limit property taxes, he writes:

”Soon, the market would resemble California since its own property-tax limitation. Old families live cheaply in big houses, while the young pay huge rents to live in garages.”

LVT in the News and Beyond

If all of the electoral progress were not enough, land value tax has also been showing up across the media landscape in a way we have not seen in years. Over the past two months, national outlets, local newspapers, think tanks, and digital creators have all taken up the topic. Below is a roundup of some of the most interesting recent coverage and commentary:

- New America, a DC-based think tank active in housing policy, has a series on innovative solutions to bolster housing supply. They included a piece by me making the case for land value taxes as perhaps the most powerful lever local governments can pull to unlock more housing.

- Realtor.com featured my colleague Lars Doucet in an article that traced back the origins of the Monopoly board game. The article spurred Lars to dive deeper into the Monopoly analogy and how it relates to the growing interest in LVT.

- Washington Examiner, a right-leaning DC-based newspaper, may be quite Georgist. They published not one, not two, but three articles with nods toward land value taxes in the past couple of months. They have particularly done a great job of calling out Republican politicians across the country calling for complete abolition of property taxes, primarily in the first piece. In the second piece, they sharply critique the Trump administration and Bill Pulte’s proposal for a 50-year mortgage, arguing instead for a focus on land value taxes. And finally, they review Mike Bird’s book, which Lars recently reviewed on this Substack. (Jacobin also has a good interview with Mike Bird on his new book).

- Garrett Fulce, a Republican lobbyist in Texas, also offered a sharp critique of proposals to eliminate property taxes and made the case in the Houston Chronicle for a Land Value Tax.

- Matt Caldwell, a former Florida state representative and current Lee County Property Appraiser, has also written in support of land value tax in a state where the governor is a strong advocate for the complete abolition of property taxes.

- The Governor’s office in Delaware has expressed interest in exploring a land value tax amid backlash to reassessments across the state.

- Vital City lays out a housing roadmap for Mayor-elect Mamdani. As part of it, they note that New York City already has legislative authority to enact land value taxes around major transit projects.

- Baltimore Thrive published a piece in the Baltimore Sun laying out the case for a land value tax in a city with high vacancy and high property tax rates.

- In the UK, the Greater Manchester Mayor has endorsed land value tax.

- Dan Brennan, a Baltimore resident and Oxford history doctoral candidate, published a piece in Fusion Magazine which offers a Georgist rebuttal to another piece which advocates for the sale of federally-held public land to unlock more housing supply.

- Finally, in digital media, Hoog released an interesting Youtube video on Netherlands’ plan to build 10 new cities. Around minute 25 of the video, the piece has quite a good animated explanation of land value taxes and the relationship to the Netherlands dilemma.

This Landscape is full of reasons to be optimistic. The coalition is broadening, the arguments are strengthening, and the political opportunities are multiplying. I hope you come away with the same sense I have after tracking these developments: land value tax is becoming a national conversation.

Greg Miller is the Executive Director of the Center for Land Economics.

Leave a reply to Kjaren Cancel reply